AS THE END OF THE FINANCIAL YEAR LOOMS

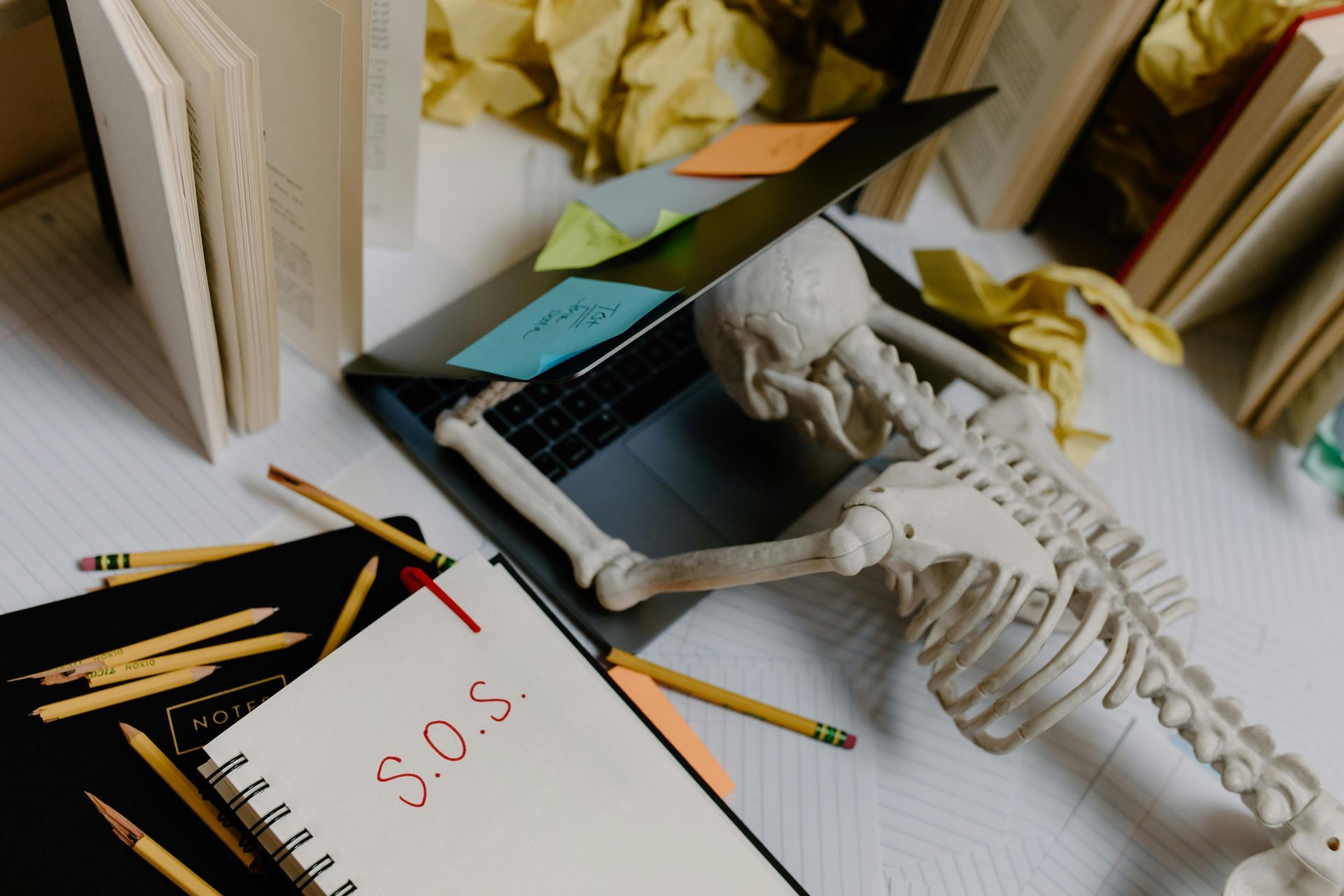

As the end of the financial year approaches for businesses in New Zealand, March 31st looms as the critical deadline for most. Its easy to feel overwhelmed by these extra tasks amid the hustle and bustle of daily operations. While some may view it as old-fashioned, maintaining a priority list for your end-of-year financial tasks can help you stay organized, especially for those items requiring input from others.

An important item on that list is always getting those outstanding invoices paid, in the bank. Then tidying up the bank reconciliation, there are always those pesky transactions that need to be reconciled and/or receipts found that are floating around somewhere.

The significance of accurate end-of-year accounts cannot be overstated. They facilitate the proper claiming and payment of taxes, provide valuable data for managing growth throughout the year, serve as a foundation for budgeting in the new financial year, and offer insights into the performance of your products or services through precise profit and loss statements. Without accurate financial records, assessing pricing performance becomes challenging, leading to potential long-term issues.

Ensuring your profit and loss statements are accurate is crucial for evaluating pricing strategies effectively. Flawed financial data can skew the perception of performance and hinder informed decision-making. Over time, this discrepancy can evolve into a substantial problem, impacting profitability and overall business viability.

In conclusion, as the financial year draws to a close, it's essential to prioritize tasks that contribute to the accuracy of your end-of-year accounts. By addressing outstanding invoices, reconciling bank transactions, and maintaining precise financial records, you set the stage for informed decision-making, effective tax management, and sustainable business growth. Embrace the discipline of consistent effort, and reap the rewards of a well-managed financial year transition.

This is where your bookkeeper will shine. All of the above is just part of what they contribute to your business. If you do not have your own bookkeeper or Accounts Manager then I strongly suggest you give me a call.

Your business deserves the investment.

As always, if you found this interesting please share with friends, family and business owners you may know.